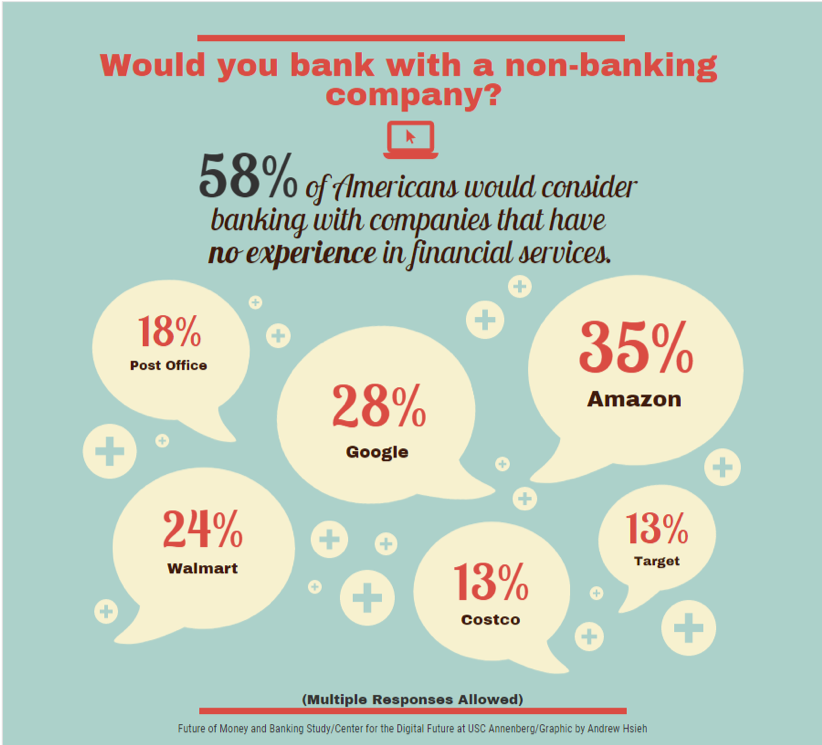

Would Americans consider putting their money in an “Amazon Bank” or “Google Financial Services”?

In a new report by the Center for the Digital Future at USC Annenberg School for Communication and Journalism, more than half said yes.

“We strongly believe banking is the next industry to be completely disrupted by digital change,” said Jeffrey Cole, director of the Center for the Digital Future. “Our research shows customers are far ahead of the banks in looking to the web and apps as their preferred banking methods.”

The Center for the Digital Future has studied and tracked Internet use and digital technology for the past 18 years around the world on a variety of issues and has learned that companies facing disruption, especially technological ones, seldom turn themselves around.

Graphic by Andrew Hsieh

“Disrupting short-term profits to make the changes necessary to transform the direction of the company is too painful and strongly inhibited by shareholders’ immediate interests,” said Cole.

The center’s most recent study, The Future of Money and Banking, was released on April 2. The study found a large percentage of Americans — given the same guarantees as traditional banks — would consider moving their money to accounts offered by companies with no experience with financial services such as online retailers, search engines, or big-box stores.

“Disruption is what digital technology does,” said Brad Berens, chief strategy officer. “If you look at American businesses five, ten or twenty years ago, there has been a shocking amount of change. For example, the business of selling records or CDs, which was a huge multi-billion-dollar industry as recently as 20 years ago, has nearly evaporated, transitioning first to MP3s and then to streaming services like Spotify.

As the digital landscape is evolving for financial services, so are Americans. Seventy-two percent of Americans use their mobile phone for online banking, and 37 percent cited online or mobile services as a reason for choosing their current bank. An added convenience of using a mobile banking is it enables customers to track their money wherever they are — it’s the fastest way to conduct financial transactions. Notifications and alerts are an added feature.

“There’s a lot happening here right now in terms of banking that can change the industry today,” Cole said. “Amazon, for example, having recently acquired Whole Foods Market, is on the ground. It could easily open bank branches in stores around the country.”

One of the biggest surprises that came out of the Future of Money and Banking Study was that 80 percent of customers were either satisfied or very satisfied with their bank. One-third of this same group of people — when asked if they would change to online or mobile services alone — said yes.

The Future of Money and Banking Study polled a nationally-representative sample of 1,007 Americans age 18 or older who have bank accounts. The margin of error is plus or minus three percent.

Since 1999, the Center for the Digital Future in the USC Annenberg School for Communication and Journalism has examined the behavior and views of a national sample of Internet users and non-users in major annual surveys of the impact of the Internet on America. The center also created and organizes the World Internet Project, which includes similar research with 37 international partners.